The law protecting employee’s rights in bankruptcy or liquidation of a corporation.

The law for security of employee’s rights when an employer goes bankrupt or when a court verdict orders the liquidation of a corporation came into being in 1975, in order to protect employees whose rights have been compromised due to difficulties the employer has come into and as a result of these difficulties a bankruptcy or liquidation order has been issued by a court of law.

This law is defined specifically in Chapter 8 of the Social security law.

According to this law, a salaried employee whose employer has declared bankrupcy or the company he has worked for has been liquidated, is entitled to payment for salary and severance pay that the employer owes him, up to the ceiling of the stipend as determined by the law. The employee is also eligible that Social security transfer monies owed to his pension or savings plan if the employer has not deposited the required amounts owed (all or some).

Who is eligible ?

- Salaried employees that their employer has declared bankruptcy or salaried employees that a court has issued a liquidation order against their employer (provided the employer is a corporation)

- Pension/ Gemel fund if the employer owes money to a fund that the employee is ensured with.

- Member of a co-operative who has been a member of a Kibbutz or a collaborative Moshav for at least 7 years

- An employee’s next of kin if an employee passed away before the benefit owed him was paid, his next of kin are eligible to receive the debt for salary and severance pay.

- Foreign workers / Yehuda – Shomron workers are eligible provided they have legal and valid work permits and visa. Illegal aliens are not eligible.

Conditions of eligibility

The benefit will be paid to a salaried employee if the following conditions are met:

A) A District court has issued a bankruptcy order or liquidation order to a company, co-operative, collaborative or Non-profit organization.

B) A district court has appointed a Trustee or liquidator to above.

C) The details of the employee’s claim have been acknowledged by the trustee or liquidator of the company.

How is the benefit calculated ?

An employee whose employer has been issued a bankruptcy order or liquidation order is eligible to receive a benefit from Social security, which includes amounts of salary owed him, that haven’t been paid by the employer and also amounts of severance pay that have no coverage in a pension / Gemel fund.

The benefit will be paid up to a ceiling of 79,750 sh for court orders issued up until July 31, 2009 or 103,675 sh for orders issued from August 1, 2009 onwards.

The amount of the benefit will include linkage from the date the debt was incurred until the payment date by Social security.

Salary items that are taken into account

- Salary: according to section 1 of the protection of salary law that hasn’t been paid by the employer to an employee until the date he ceased work.Itemized salary that will be taken into account include: Base salary, overtime hours, premiums, bonuses, commissions, and any additions that are paid due to effort, or departmental or professional reasons.The salary to be taken into account will not be less than minimum wage owed the employee according to his percentage of position (full-time, part-time). A benefit that is calculated according to minimum wage will be calculated for a period of up to 12 months.

- Buyout of accrued vacation day balance: payment for the number of accrued and unused vacation days up until the date he ceased work, as they appear on his last pay slip, up to the maximum number of days that can be accrued by law and subject to the Annual vacation law.

- Havra’a (convalesence pay): the part that was not paid to the employer up until the date he ceased work and for the last two years.

- Clothing stipend: the part that was not paid to the employer up until the date he ceased work and for the last year (relevant only in places of employment where this stipend is paid – usually public sector only)

- 13th salary: the part that was not paid to the employer up until the date he ceased work and for the last year (relevant only in places of employment where this stipend is paid – usually public sector only)

- Value of advance notice: employees whose employer did not pay them the value of advance notice will be eligible to receive as part of the benefit, according to the Advance notice for termination and resignation law (2001).

- Employer’s portion towards pension: employees whose employer did not open a pension plan for them as required by law are eligible to claim the employer’s portion of 6% of the base salary and for a period that will not exceed 12 months after employer-employee relations were severed.Note: Any other itemized items on the payslip can be included as well, as long as they fit the definition of salary. Items that will not be included in the calculation of the benefit (for example) refunded car or telephone expenses, etc.

The claim for a benefit is to be sent to the court-appointed Trustee or liquidator only and not to Social Security on a form 5305/bl (original only) along with documents to back up the claim. The form is available online on Social Security’s website: www.btl.gov.il or at Social Security’s Head office in Jerusalem – branch office (located behind Binyanei Hauma – 13 weizman st. Tel 02-6463020).

The appointed trustee or liquidator has approved the claim he will send it to Social Security’s head office.

Applications for claims relating to pension /gemel funds are to be submitted to the trustee or liquidator by the fund.

Tips

- Always keep a copy of all documents for your own records

- Never submit original documents, make photocopies of payslips, contract, etc to attach to the claim.

- Send the claim to the trustee / liquidator via registered mail with proof of delivery or submit in person and get them to stamp your copy “received” with the date on it.

- Social Security recommends filling out the claim form in detail and accurately in order to avoid unnecessary delay in processing your claim.

Source: Social Security (Bituach Leumi)

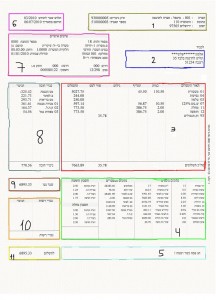

Here is an explanation of the Israeli payslip for the perplexed: Broken down into color-coded sections. This article was a guest post I wrote for www.israemploy.net in 2010.

Here is an explanation of the Israeli payslip for the perplexed: Broken down into color-coded sections. This article was a guest post I wrote for www.israemploy.net in 2010.